Vast fossil fuel investments of Scottish local government pensions revealed

New data published in the Sunday Herald today reveals that Scottish local authority pensions have an astonishing £1.7 billion invested in fossil fuel companies, such as Shell and BP.

Before today it was not known the extent to which the funds, held by Scotland’s 11 Local Government Pension Schemes on behalf of council workers and related organisations, were exposed to the “carbon bubble”.

The research, carried out by Friends of the Earth Scotland, volunteers and partners shows that:

* The £1,664 million (£1.7 bn) invested in fossil fuels represents 5.2% of the total value of the funds.

* This represents £311 per Scottish resident, invested in coal, oil and gas by local government.

* Money is invested into multinational fossil fuel companies including £56 million in Rio Tinto, £39 million in BP and £31 million in Shell.

* Strathclyde Pension Fund came top in Scotland and second largest in the whole of the UK, with £752 million invested in fossil fuels.

* Of the six pension funds investigated by the Sunday Herald in 2014 the total value invested of fossil-fuels has increased by £300 million to £1.4 billion.

The news comes at a time when fossil fuel investments have been falling in value, posing both financial and environmental risks to funds.

Campaigners are calling for funds to invest in line with a scientific evidence that shows that 80% of fossil fuel reserves need to remain in the ground to avoid catastrophic climate change.

Action on climate change will leave fossil fuel investments worthless, creating a carbon bubble which would be deeply damaging to any funds exposed to them.

Scottish organisations such as the United Reform Church, University of Edinburgh and University of Glasgow have already made moved to quit investing in fossil fuels, joining 389 institutions globally that have committed to divest.

Pensions can be invested sustainably. In February the Strathclyde Pension Fund announced a £10 million investment in smaller-scale renewables and in 2014 the Falkirk fund invested £30 million in social housing.

Comments

Dave Watson, Head of Bargaining and Campaigns at UNISON Scotland has supported the Fossil Free campaign said:

“Local authorities have a duty to cut carbon emissions under the Climate Change (Scotland) Act. This, together with the growing financial risk, is a major factor Scottish local authority pension funds need to consider when making investments in the fossil fuel and similar industries.

“Divesting from fossil fuels is the prudent way for councils to meet both their fiduciary duty to members and their public law duties.”

Alison Johnstone, MSP for Lothian, has asked questions in the Scottish Parliament about fossil fuel investment. She said:

“Pension schemes are supposed to provide security for workers when they retire. At the moment, our local authorities are playing reckless games with their employees’ money, and it’s time the Scottish Government took more action on this issue.

“Oil, gas and coal are running out, and the fossil fuel industry is no longer a sustainable, sensible investment choice.

“Scottish Ministers and public sector pension schemes should urge local government to ask their members how they want their pensions to be invested.”

Cllr Jim Orr, Edinburgh City Council Pensions Committee said:

“There is a growing recognition that pensions and other long term investments often support patterns of unsustainable and hugely damaging fossil fuel consumption.

“What we need is for more stakeholders, particularly individual pension scheme members, to make their voices heard so that there is pressure for investment strategies to reflect their wishes.”

Maggie Anderson, Lothian Pension Fund member said:

“The only thing that makes sense is to invest in renewables. We need to look to the future, not kill it by persisting with what belongs in the past. That’s what I would hope for from my pension fund, especially in Scotland which has so many natural resources of renewable energy.”

Kirsty Noble, Strathclyde Pension Fund member said:

“Local governments and their pension funds really have to take the lead in action to avert climate change – whatever the rest of us do individually is small in comparison with the potential for government action.

“Given the growing understanding of the need to ‘keep it in the ground’ these investments are increasingly risky and the local authority funds seem to be overexposed to this risk.”

Ric Lander, FoE Scotland campaigner for Fossil Free pensions said:

“Communities around the world are calling for an end the environmental destruction that comes with coal mining, fracking and deep-sea oil.

“Our pension money shouldn’t be fuelling this damage: at time when public resources are being squeezed, we should be redirecting this money to socially useful projects such housing and clean energy.

“Across Scotland people from churches, unions, universities and community groups are asking why so much of their money is invested with so little accountability. Funds should listen to their members and make a shift away from dirty energy and towards clean and safe investments.”

Notes to Editors

1. The fossil fuel divestment campaign is a growing international movement calling on institutions to divest (sell their shares) from fossil fuels to take action against catastrophic climate change.

2. The new data, unearthed with the help of volunteers, has been revealed as part of a UK-wide campaign to encourage local government pensions funds to quit fossil fuels and invest sustainably. On Thursday 24 September details of the investments of all UK local government pensions will be published with Fossil Free UK and the Guardian newspaper.

3. The data was sourced by 350.org, Community Reinvest, Platform, Friends of the Earth Scotland and Friends of the Earth (England Wales and Northern Ireland), working together as “Fossil Free UK”. Information was compiled primarily from data obtained using the Freedom of Information Act.

4. A divestment commitment is a principled commitment to wind down exposure to the Carbon Underground top 200 fossil fuel companies over a 5 year period.

5. The Local Government Pension Scheme is one of the largest public sector pension schemes, with 4.6 million members across the UK.

6. Officers and representatives responsible for LGPS funds have a responsibility carry out “fiduciary duties” by acting not in their own interests, but in the best the interests of fund members. The Scottish Local Government Pension Scheme Advisory Board is currently undertaking clarification of Scots Law to clarify what responsibilities LGPS funds have to invest in an environmentally and socially responsible way and how they can respond to members concerns.

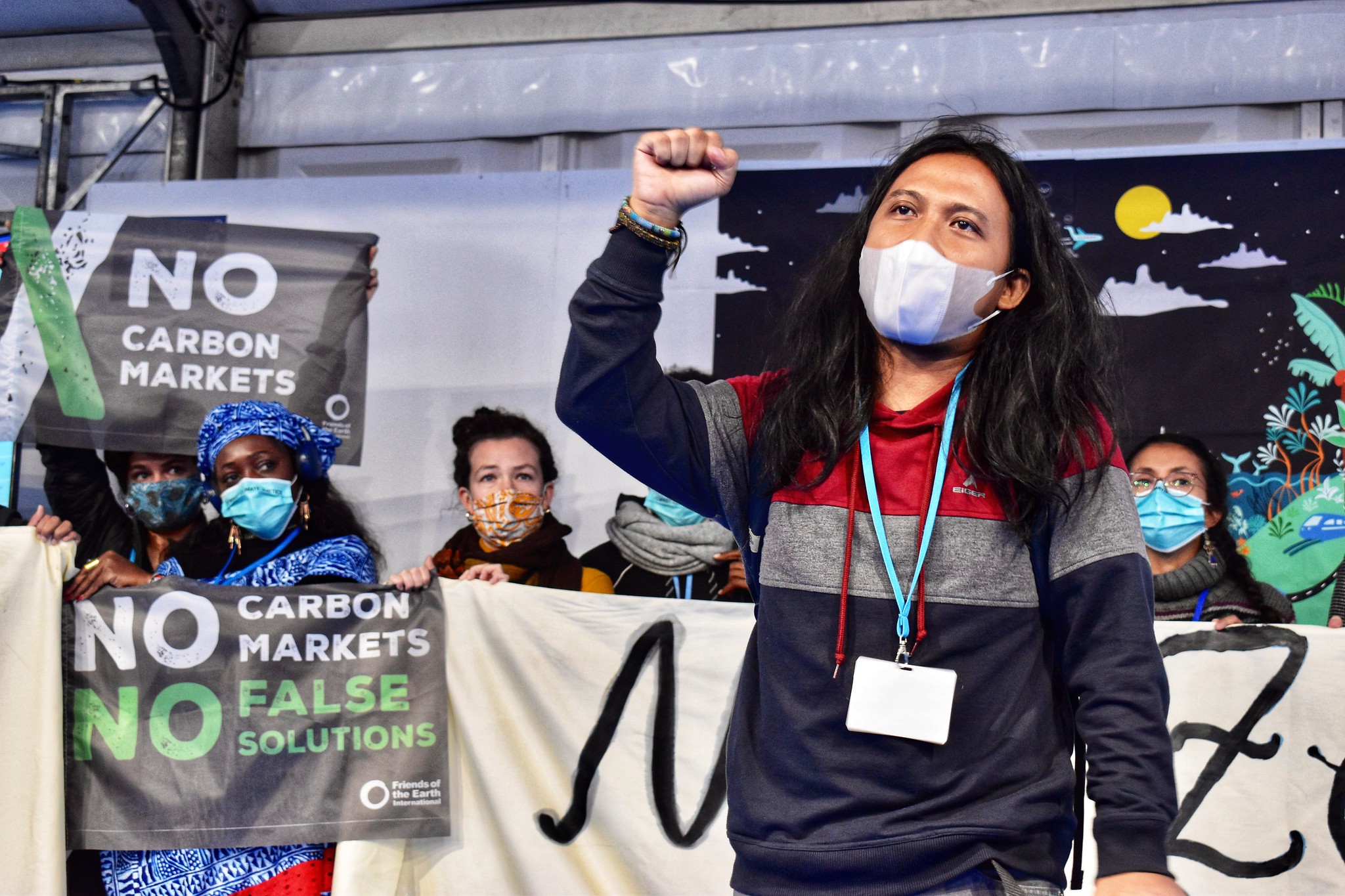

7. An accompanying infographic and set of free-to-use photos is available on request from rlander[at]foe-scotland.org.uk.

8. For a full view of the data visit the UK Interactive map and download the UK report: ‘Local government pensions, fossil fuels and the transition to a new economy’.

9. Friends of the Earth Scotland is:

* Scotland’s leading environmental campaigning organisation

* An independent Scottish charity with a network of thousands of supporters and active local groups across Scotland

* Part of the largest grassroots environmental network in the world, uniting over 2 million supporters, 74 national member groups, and some 5,000 local activist groups. www.foe-scotland.org.uk