RBS: Stop defrauding us, manipulating us, lying to us and trashing our climate

Originally posted as a guest blog on WDM on Thursday 28/3/12

The Royal Bank of Scotland (RBS) reported a £5.2 billion loss as it announced its annual results today The bank’s boss Stephen Hester is four years into his original five-year plan to bring RBS back on track – yet things don’t seem to be getting much better for the publicly owned bank. RBS blames a year of heavy fines. But let’s just remind ourselves of what these fines were:

PPI: The bank knowingly mis-sold its customers insurance which they neither needed nor could use, over a period of years. Fine: £2.2 billion

Libor: The bank illegally manipulated a crucial interest rate to benefit itself whilst negatively affecting mortgage payers in the UK (and elsewhere). Fine: £391 million

Bankers this year have been rewarded for doing a ‘good job’. Bonus pot: £600,000 million

Some pretty significant figures that the bank should never have been in a position to pay.

If the RBS was really making headway to being sustainable and acting in the interest of us and its shareholders, we would surely expect a much stronger annual report, and a move towards investments only in sustainable projects.

Hester is quoted on the BBC website this morning as saying “…my job is [to] deliver an RBS that other investors want to own shares in…” This is true, but he must also remember that RBS is still owned by UK taxpayers and it is also his job to ensure that the bank is cleaned up and takes good care of our investment. Stopping defrauding us, manipulating us, lying to us and trashing our climate and environment would certainly be a good place to start. Hester has a lot of ground to cover in the final year of his plan.

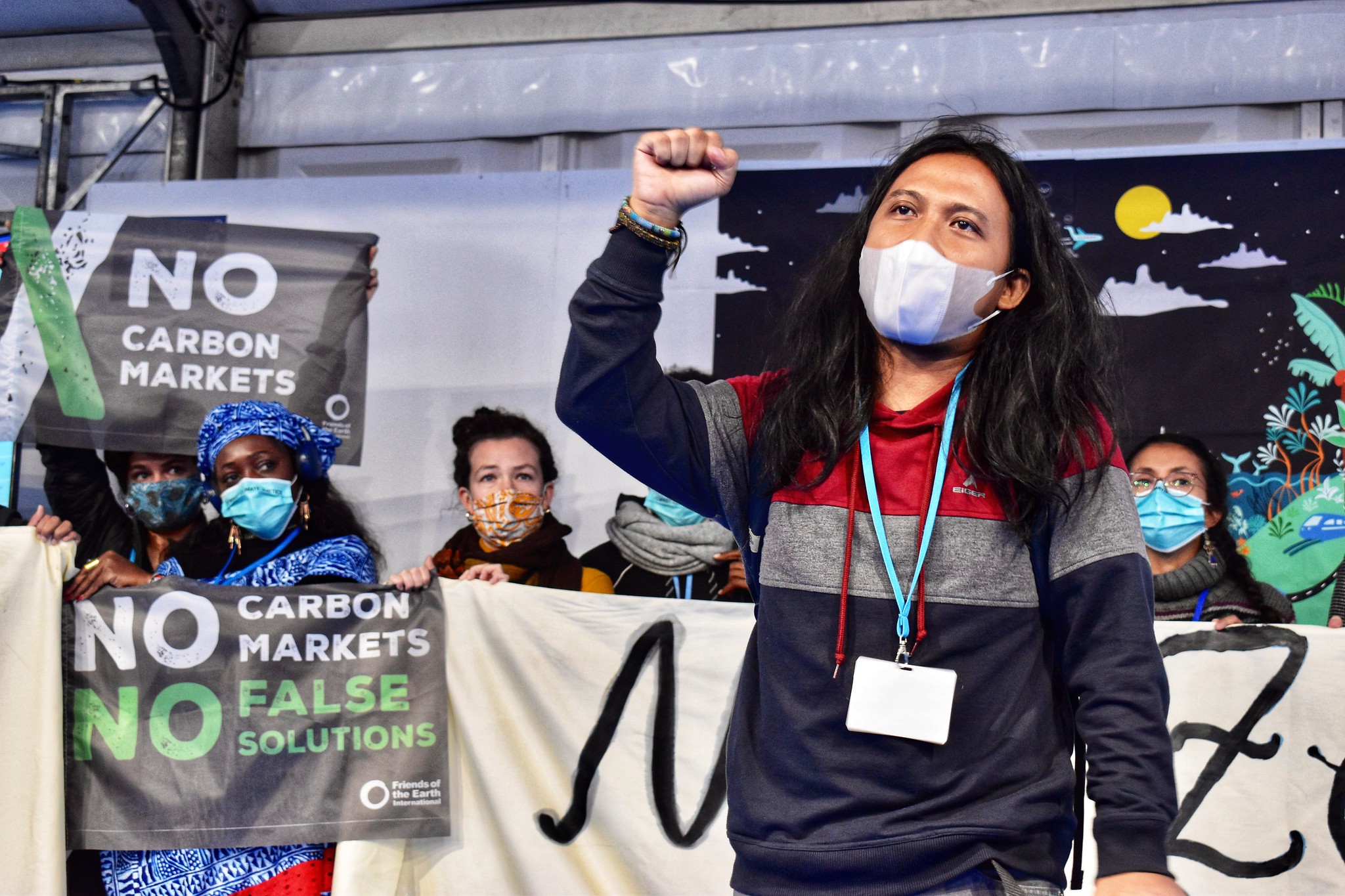

Read more about the Friends of the Earth Scotland RBS campaign