Divest Local Government

Let's divest Scottish council pensions from the climate crisis

Pensions and us

Pension funds have a duty to look after their members in retirement. But as some of the largest investors in the world, pension funds also have a profound capacity to shape the future we retire into.

The climate crisis is forcing workers, pensioners, investors and policy-makers to consider if and how their money is making a difference.

In Scotland the Local Government Pension Scheme, valued at £48 billion and administered by 11 local authorities, constitutes the country’s largest public store of wealth.

For the most part this money, and the effect it has on our lives, is hidden from view. This new research reveals an up-to-date picture of how this money is invested in some of the world’s most damaging companies.

Pension fund members and local people have been organising to change this through fossil fuel divestment, an initiative that has won policial and financial support, but as yet, has not been realised throughout in the Scottish Local Government Pension Scheme.

In revealing the precarious scale of council pension funds’ ownership of fossil fuels we hope to enable action for divestment: to end the harm of fossil fuels and invest instead, in a greener, healthier Scotland.

This briefing summarises the fossil fuel investments of Scotland and the UK’s local government pension funds, building on similar work carried out in 2015 and 2017[1], considers some examples of the companies uncovered, and puts forward a case for action.

Pensions and fossil fuels

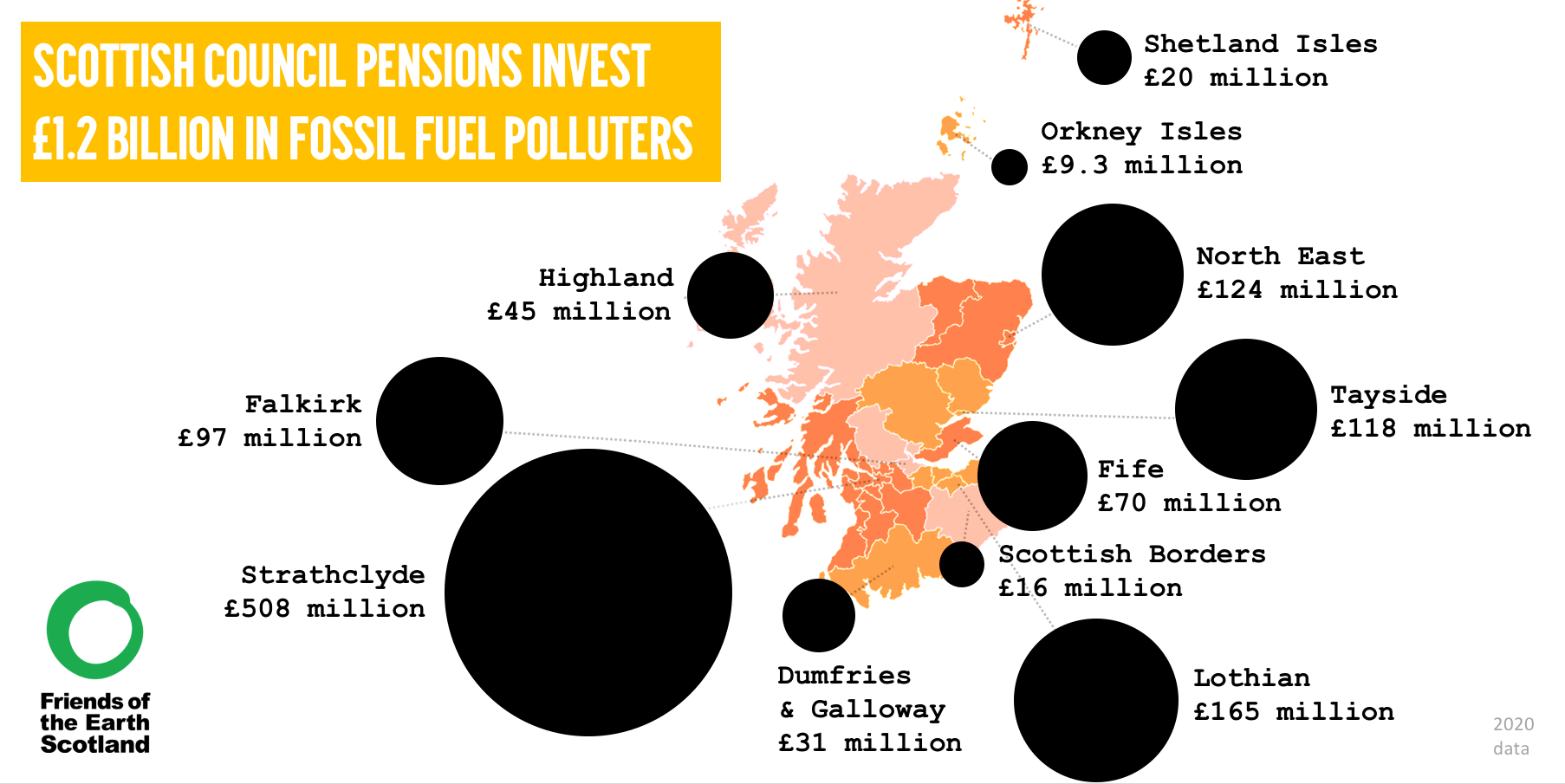

The new analysis, carried out by Platform and the most comprehensive yet, shows that as of March 2020 Scottish local council pensions invested £1.2 billion in fossil fuels. For the UK the figure is nearly £10 billion.[2]

The biggest investor in Scotland is also the country’s single biggest local government fund. The Strathclyde Pension Fund, administered by Glasgow City Council, was found to have invested £508 million in fossil fuel companies, 42% of the Scottish total.

The Local Government Pension Scheme has 6.8 million members across the UK and this analysis shows on average each individual member has £1,450 invested in fossil fuels.

The value of local government pension fund investment in fossil fuels has fallen over time. Our 2015 study found 5.2% of Scottish funds was invested in fossil fuels, whilst this new 2020 analysis shows that 2.5% of Scottish funds are held in fossil fuel firms. A similar trend is observable across the UK.

Although the methodology between the studies is not directly comparable, the downward trend is clear.

UK Local authority pension fund investments in fossil fuels, 2015–2020

| UK | Scotland | |||

| £ million | % total | £ million | % total | |

| 2015 | 13,800 | 6.0 | 1,665 | 5.2% |

| 2017 | 16,100 | 5.5 | 1,811 | 4.2% |

| 2020 | 9,859 | 3.0 | 1,204 | 2.5% |

Unfortunately much of this change is down to the falling value of initially coal, and later oil and gas companies.

An analysis of the changes between 2017-20 found that at least £2 billion of value had been wiped off the oil and gas investments of the UK Local Government Pension Scheme. In Scotland £194 million was lost.[5]

The largest loser in Scotland was the Strathclyde Pension Fund which lost £46 million and the Lothian Pension Fund which lost £36 million. These amount to losses of £626 per member of the Strathclyde Fund and £429 per member of the Lothian Fund.

| Local government pension fund | Financial losses from oil and gas investments, 2017-20 |

| Strathclyde Pension Fund | -£46,374,450 |

| Lothian Pension Fund | -£36,077,023 |

| Falkirk Council Pension Fund | -£34,769,723 |

| Tayside Pension Fund | -£30,005,131 |

| North East Scotland Pension Fund | -£15,780,431 |

| Dumfries and Galloway Pension Fund | -£13,506,338 |

| Highland Council Pension Fund | -£11,650,109 |

| Fife Council Pension Fund | -£2,356,219 |

| Scottish Borders Pension Fund | -£1,968,406 |

| Orkney Islands Council Pension Fund | -£1,625,133 |

As losses mount local councils may face serious questions about why they continued to invest in an industry which is shedding value.

Action by local and national governments to curb fossil fuel use, as laid out in their climate emissions policies, will further dent fossil fuel share values. Investors will not be fulfilling their legal duties to employers or fund members if they do not take seriously the financial risks of continued investment in the industry.

Fossil fuels in the spotlight

The burning of fossil fuels is the main driver of climate change. Further extraction and burning of fossil fuels is not compatible with a just, safe and fair future and investing in fossil fuels is deeply irresponsible.

Despite many local authorities declaring a climate emergency, UK local authority pensions are invested in a wide array of UK and global fossil fuel polluters.

Despite dramatic falls in the industry’s global fortunes and UK coal power generation coming to an end in 2025,[6] local government pensions still held over £3 billion of investments in the industry.

UK local government pension investments in coal, oil and gas investments

| (£ million) | (% total) | |

| Coal | 3,364 | 1.0 |

| Oil and gas | 6,495 | 2.0 |

| Total | 9,859 | 3.0 |

Together the three most prolific companies in our analysis: BP, Shell and BHP account for 40% of the direct investments of local government pensions.

All three are also among the top 20 companies with the highest historic climate emissions, according to the respected Carbon Majors study.[7]

Royal Dutch Shell: £43.6 million directly by Scottish funds: Lothian, Falkirk, Tayside, Strathclyde and North East.

UK-Netherlands based Royal Dutch Shell has been associated with a number of environmental and human rights violations worldwide. They have threatened to drill in the fragile environment of the Arctic[8] and the company is involved in shale gas fracking, a highly polluting form of drilling.[9] In January 2021 a Dutch court ruled that Shell must compensate a number of Nigerian villages for loss of life, illness and destruction caused by their pollution.[10] The company operates part of the Mossmorran gas plant in Fife, one of Scotland’s largest polluters.[11]

BP: £39.0 million directly invested by Scottish funds: North East Scotland, Fife, Falkirk, Lothian, Strathclyde and Highland.

UK-based BP are one of the world’s biggest fossil fuel producers. After spending a brief period branded as beyond petroleum BP have continued to explore for new oil and gas, including in Scottish waters.[12] BP have been found to have close ties with the oppressive regime in Azerbaijan.[13] They were fined $18.7 billion, the largest environmental fine in US history, for the ‘gross negligence’ regarding the 2010 Deepwater Horizon spill which devastated the Gulf of Mexico.[14] The company is a financial backer of the proposed gas export scheme in Mozambique which has been associated with forced displacement and militarisation.[15]

BHP: £56.6 million directly invested by Scottish funds in Tayside, Highland, Falkirk, North East Scotland, Scottish Borders, Lothian, Fife and Orkney Isles.

Mining company BHP is based in the UK and Australia. It is the world’s second largest miner by market capitalisation.[16] They are part owners of the Cerrejon coal mine in Northern Colombia, South America’s largest open-cast mine. Its expansion has affected many local people and it’s been reported that the company is under investigation by the OECD for environmental and human rights abuses.[17]

Ill-equipped for the future

Many investors, including local government pensions, have sought to change the behaviour of fossil fuel companies while continuing to invest.

Unfortunately investors are not asking the right questions and not getting the right answers. A study of global pension funds representing ownership of £70 billion of fossil fuel assets found only one example of direct engagement with a fossil fuel firm where the company was asked to keep their fossil fuel assets in the ground, and even this did not lead to a commitment to do so from the firm.[18]

Decades of engagement have born little fruit, and time has run out. A 2020 study of 125 companies found that “no major oil, gas or coal company is on track to align their business with the Paris climate goal of limiting the global temperature rise to well below 2°C by 2050.”[19]

On occasion engagement has been effective at securing small and specific changes to company practice. But the tool is unsuitable in the case of fossil fuel companies and climate because the industry’s entire supply chain exists to extract fossil fuels: it’s their core business. For big oil, real climate action means winding down their activities or making a wholesale switch out of fossil fuels and into renewables, something no fossil fuel company appears equipped to do.

Fossil fuel companies are not the right vehicle with which to drive the future energy economy. Investors seeking to back the future energy economy would be much better placed investing in renewable energy firms.

Global climate action

Local and national government policy is providing a guiding framework for cutting climate emissions and fossil fuel use.

Scotland and the UK are legally required to make cuts to climate emissions towards the eventual goal of “net zero”. Local governments and public agencies must contribute, and many local governments have set their own more ambitious targets. In 2019 local governments across the country declared a “climate emergency”.[20]

In 2019, fracking was finally banned across the UK[21] and in 2020, the UK Government announced an end date for sales of new fossil fuel vehicles[22] and committed to stop financing fossil fuel abroad.[23]

Climate policies have wide and deep public support. In the UK people are more concerned about climate change than ever before[24] and in a recent global poll of more than a million people 64% said climate change requires “urgent action”.[25]

Furthermore, in 2021, climate action has been given fresh impetus with the incoming US President who has scrapped pipeline projects and brought new funds into green jobs.[26] This shift should gain further momentum with the attention brought by the UN climate talks, due to take place in Glasgow in November 2021.

The direction of travel away from fossil fuels and towards a sustainable energy system is clear.

Continued investment in fossil fuels is undermining efforts to go green. It’s banking on the problem when investors should be backing solutions.

Council investments in polluters represent a conflict of interest as any local action to curb climate pollution will adversely affect pension investment.

It is also embarrassing for Glasgow City Council, who will be playing host to the world at COP26, to be administering Scotland’s largest single pool of fossil fuel pollution investment.

Divest from the problem, invest in solutions

Change that is both good for the planet and good for returns is possible.

Six local government pension funds, half of all UK Universities and over 1,309 global institutions representing over $14.6 trillion in assets have already gone fossil free.[27]

Divestment cuts out the financial risk of fossil fuels and takes power away from companies that are harming our future.

In recent months support for divestment has been growing fast:

In July, the UK’s largest pension fund by membership NEST announced divestment from coal, Arctic oil and gas, and tar sands.[28]

In August, the Lothian Pension Fund, one of Scotland’s largest public investors, announced it will no longer invest in fossil fuel debt, a major win for the five-year long Divest Lothian campaign.[29]

In October, Glasgow City Council, which administers one of Europe’s largest pension funds, announced its draft climate emergency policy requires the Council “to encourage pension fund investors in the city to develop a strategy for divestment from the fossil fuel industry by 2025”.[30]

In November, the University of Dundee announced complete withdrawal from fossil fuel investments, meaning well over half of Scotland’s universities are now on their way to being fossil free.[31]

In December, the UK Government announced an end to financing for fossil fuels abroad, a practice worth many billions to big oil.[32]

Globally some hugely influential organisations began to move their cash in 2020, the University of Cambridge[33], New York State[34], Lloyds of London[35] and the Welsh Parliament[36].

Councillors across the country have backed action on fossil fuel investments and over 20 MSPs have backed divestment of the Scottish Parliament’s pension fund.

Many investors are using this as an opportunity to invest in sustainable alternatives and some Scottish council pension funds have tentatively begun investing in green social housing and renewable energy, supporting local economies.

Our 2017 investigation found that Scottish local government pensions had invested in small hydroelectric and wind power schemes, as well as social housing developments in the East of Glasgow and Forth Valley. Such investments represent a double benefit to pension fund members and local councils: a secure return and a healthier future.[37]

Taking action

For Councillors

- Pass a divestment motion[38] to sell all shares in fossil fuel companies within a defined number of years.

- Seek representation on your council’s pension fund committee and push for action on fossil fuel investments.

- Work with your local community to identify local investment projects the pension fund could fund, as other pension funds have done.

- Contact councils who have moved to divest their pension, or would like to do so.

For fund managers

- Implement investment beliefs that allow decarbonisation goals and risk parameters to work together, not against each other.

- Put in place financial performance measurement benchmarks together with decarbonisation goals – to recognise the energy transition and adjust accordingly.

- Ensure that investment consultants and fund managers don’t think this is an Environmental Social Governance (ESG) issue. It is a classic risk issue, as the transition is fundamentally disrupting markets.

For all of us

- Support action to keep all fossil fuels in the ground and reject any false solutions that fail to deliver this aim.

- Find out what your council invests in and talk to your neighbours about it. Remember, our pensions are for us: how they are invested is up to us too.

- Join one of the many local divestment campaigns across the UK. If there is none in your area, set one up.

- Contact your local councillor asking them to support fossil free investments.

- Contact trade union branches in your area and ask them to put you in touch with those eager to push for divestment. If they cannot suggest anyone, ask to make a presentation about it.

Notes and sources

This briefing was based on research and analysis carried out by Platform with the support of Friends of the Earth England, Wales and Northern Ireland and Friends of the Earth Scotland.

[1] ‘Local Government Pensions, Fossil Fuels, and the Transition to a New Economy’ (2015) https://foe.scot/resource/local-government-pensions-2015 and

‘Councils: Fuelling the Fire’ (2017) https://foe.scot/wp-content/uploads/2017/11/Councils-Fuelling-the-Fire-Online-1.3.pdf

[2] The source data was obtained through Freedom of Information requests and our full methodology can be found in the full report.

[3] These local authorities did not appear to fully disclose their holdings because the total was more than 10% lower than the figure in their 2019/2020 annual report (Lothian (−52%) and Scottish Borders (−34%)). We accounted for this difference by assuming that the undisclosed assets had the same fossil fuel exposures as the disclosed assets and added this to the total. For more information see the full report.

[4] ibid.

[5] This data was published in December 2020 by Transition Economics using the same data as this study. http://transitioneconomics.net/wp-content/uploads/2020/11/TransitionEconomics_Local-Gov-Pension-losses-from-oil-investments.pdf Scottish figures were released to the press by Friends of the Earth Scotland: https://foe.scot/press-release/scottish-councils-lose-194-million-as-fossil-fuel-stocks-tumble/

[6] https://www.theguardian.com/business/2018/jan/05/uk-coal-fired-power-plants-close-2025

[7] https://climateaccountability.org/carbonmajors_dataset2020.html

[8] https://www.theguardian.com/business/2015/sep/28/shell-ceases-alaska-arctic-drilling-exploratory-well-oil-gas-disappoints

[9] https://www.shell.com/energy-and-innovation/natural-gas/tight-and-shale-gas.html

[10] https://www.foei.org/news/justice-shell-compensate-nigerian-farmers-oil-spill

[11] https://theferret.scot/ineos-sse-exxon-carbon-polluter/

[12] https://www.thenational.scot/news/16908656.bp-granted-approval-new-30-million-barrel-north-sea-oil-field/

[13] https://issuu.com/platformlondon/docs/all_that_glitters_pdf

[14] https://www.theguardian.com/environment/2015/jul/02/bp-will-pay-largest-environmental-fine-in-us-history-for-gulf-oil-spill

[15] https://foe.scot/solidarity-frontline-communities-bp-agm/

[16] https://www.spglobal.com/marketintelligence/en/news-insights/research/18-top-25-mining-companies-by-market-cap

[17] https://www.abc.net.au/news/2021-01-19/cerrejon-coal-mine-colombia-in-environment-rights-abuse-probe/13069168

[18] Rempel, A., and Gupta, J. (2020) Conflicting commitments? Examining pension funds, fossil fuel assets and climate policy in the organisation for economic co-operation and development (OECD), Energy Research & Social Science 69: 101736

[19] Raval, A. (2020a) Big fossil fuel groups all failing climate goals, study shows, Financial Times, 7 October, www.ft.com/content/16091645-98b3-4041-9ca2-053fb60181ba

[20] https://www.climateemergency.uk/blog/list-of-councils/

[21] https://www.gov.uk/government/news/government-ends-support-for-fracking

[22] https://www.theguardian.com/environment/2020/nov/18/uk-ban-on-new-fossil-fuel-vehicles-by-2030-not-enough-to-hit-climate-targets

[23] https://www.gov.uk/government/news/pm-announces-the-uk-will-end-support-for-fossil-fuel-sector-overseas

[24] https://www.gov.uk/government/statistics/beis-public-attitudes-tracker-wave-35

[25] https://www.bbc.co.uk/news/science-environment-55802902

[26] https://www.bbc.co.uk/news/world-us-canada-55872331

[27] For the latest global total visit https://gofossilfree.org/divestment/commitments/

[28] https://www.theguardian.com/environment/2020/jul/29/national-employment-savings-trust-uks-biggest-pension-fund-divests-from-fossil-fuels

[29] https://www.lpf.org.uk/downloads/file/129/statement-of-responsible-investment-principles

[30] http://gcop.scot/blog/glasgow-moves-closer-to-divestment-from-fossil-fuels/

[31] https://www.thenational.scot/news/18850867.dundee-university-remove-fossil-fuel-firms-investment-portfolio/

[32] https://time.com/5920475/u-k-fossil-fuels-overseas/

[33] https://www.theguardian.com/education/2020/oct/01/cambridge-university-divest-fossil-fuels-2030-climate

[34] https://www.nytimes.com/2020/12/09/nyregion/new-york-pension-fossil-fuels.html

[35] https://www.theguardian.com/business/2020/dec/17/lloyds-market-to-quit-fossil-fuel-insurance-by-2030

[36] https://foe.scot/press-release/welsh-assembly-divest-pension-fund-fossil-fuels/

[37] https://foe.scot/wp-content/uploads/2017/08/Divest-and-Reinvest-Scotland-2017-Printable-1.pdf

[38] ‘For a template motion you can pass at your local authority please see www.divest.org.uk